EGD Special: Lessons about Cap Tables

In this episode, I’m talking about the company cap table. What it means to manage a cap table when you’re starting off with just the founders. And when you start growing and building a company, bringing on more employees, bringing on investors, who are incentivized with equity in the company. So we’re going to cover a lot of topics regarding how you can manage and model your cap table.

Transcript

Joakim Achren 2:42

I’ve gotten a lot of experiences over the years are thinking about how an entrepreneur should approach their cap table, how they should manage the structure, and what are the expectations and how you can model things as as the company starts growing. So as many of you know, I’ve started two gaming companies in my career. The first one I started back in 2005, where I owned 100% of the company when it was started. So I was a solo founder. And next games, which I found it in 2013, we had four founding members. So it was split in four ways or 25% owned by each. So there’s a lot of different variations there, which I’m going to cover today. The whole idea for this episode came from the realisation that there was already over 1000 people who had downloaded the the cap table money management and modelling template from Elite game developers, which is the most popular template that we have if you go to elite game developers.com slash templates you’ll find the cap table management and modelling template there. And you should try it out it’s it really helps you to see how the percentage that you own in the company changes when you bring on new founders, more founders, you create a stock option plan you bring on investors. So for this episode, I wanted to kind of like walk you guys through all of those moments where, where on the startup journey, you’re going to be bringing on owners into the company. Let’s go to the beginning. So at the start of the company, you’re basically just one founder an idea. There is usually a person who kicks off the process of bringing together the founding team, and then the team starts the company But at that stage, it is one founder with that idea who still owns 100%. But then then when they start building off a team, who will sort of like come together, there’s going to be a group of people. And the thought process will change a lot there were this group of people become co founders. And at that stage, it’s still 100%. owned by the founders. It’s not one person anymore. But there are, there’s a group of people who are founding this company, and they own 100% of the company. So what happens between this group, so what I, what I call this moment for splitting the equities, the co founder equity split. So we actually have a template for this as well, if you go to, to the templates page on elite game developers.com, you can find a co founder equity split tool, which you should try out. So like I told you the example of next games where we had four co founders, we did an even split of everybody getting 25% of the company, which which is quite common in the industry, especially if you feel that all of the co founders are equally sort of responsible for the success of the company, that there’s nobody who’s who sort of like, you know, a triple a superstar, versus the everybody else is just getting into the industry there, there are these situations and in that, that position, you want to think about an unequal split, which is totally fine, I would say, because India, at the end of the day, the people with the most experience will also sort of be in that position that they need to do most of the heavy lifting. And lots of the early success will sort of be on top of their shoulders that they can actually execute, as they know so much. So what really matters in

Joakim Achren 7:11

this on equal split is that the contribution levels that people will be putting into the company, that that’s fair, there’s a there’s sort of like a fairness. And it’s been discussed between the founders, what they want, how they feel that it’s not somebody who’s imposing a split, but it’s, it’s more like a group exercise. And the capital that has already been used into the company, if somebody has put been putting more money into the company than the others already to the kickoff, you know, some prototyping with some hired help and things like that, those should be taken into consideration, like the tool will help you to go through that. And I feel that the CEO should always have a bigger stake in the company. In hindsight, that that’s how, how I feel from my experience, because it will be the role of, you know, the most burden. at any stage in the company’s lifecycle. Even though you’d have a successful game, it’s still gonna be like, so much work for the CEO to take that successful game and grow it to something amazing. And you’re like I was talking about the experience, that is something that really matters. In the co founder, split. So I’ve, I’ve recently seen a few cases where there were like, four or five co founders where the split could go like 35%, to the CEO, then you have two people who are sort of very experienced, they get 25 and 25%. And then they have perhaps a creative person who doesn’t have as much experience and they give 15% to that person. Or maybe they joined like six months later when the company was sort of like being worked on already. And they have a lot of prototypes going whatnot, and they’re still bringing in founders, so they could still do, like give out 3% 2% to founders who are joining at the very late stage. Although 2% for a co founder is not something I would recommend, I wouldn’t go below 5%. And if you fundraised already, then you can think about like the dilution already. So then it could be fine to give like 3% to somebody but two is like I don’t really feel comfortable seeing 2% for a co founder. They’re not a co founder anymore in that case. So some things to consider here that I would want to highlight this. Like if you’re a coal fired Under, or you’re going into a startup as a co founder, or you would do it in the future. Like, you should think your for yourself, like, what do you think you deserve is also important, like, what is the opportunity there versus what you know, what you’re capable of, and what you’re like gonna be, you know, happy with for the next five years, the next 10 years, the next 15 years, because it could be a long, long process to get to success, and perhaps to get to turn the next page in your career. So are you willing to work without a salary is a big question like that always also goes into the territory of somebody who is happy to work without a salary should get more equity, because they’re taking more risk. So the risk level is also something that you need to consider in gaming, if you’re really experienced, I would say like, it’s not a risk that you you’re leaving your job, I feel that anybody can get a job in the game industry, if their startup fails, if they were, you know, if they already had that experience prior to doing the startup. I don’t think that’s a big problem. Risks regarding like, if the startup fails, so what a lot of companies fail constantly, it’s not the end of the world, nobody has, you know, gone down in misery for ages. It’s just a small thing if the startup fails, but you still could think about risks regarding like your family, like not like if you have kids and stuff like that, can you afford to take no salary for six months? So those kind of thoughts, you need to think about bit.

Joakim Achren 11:52

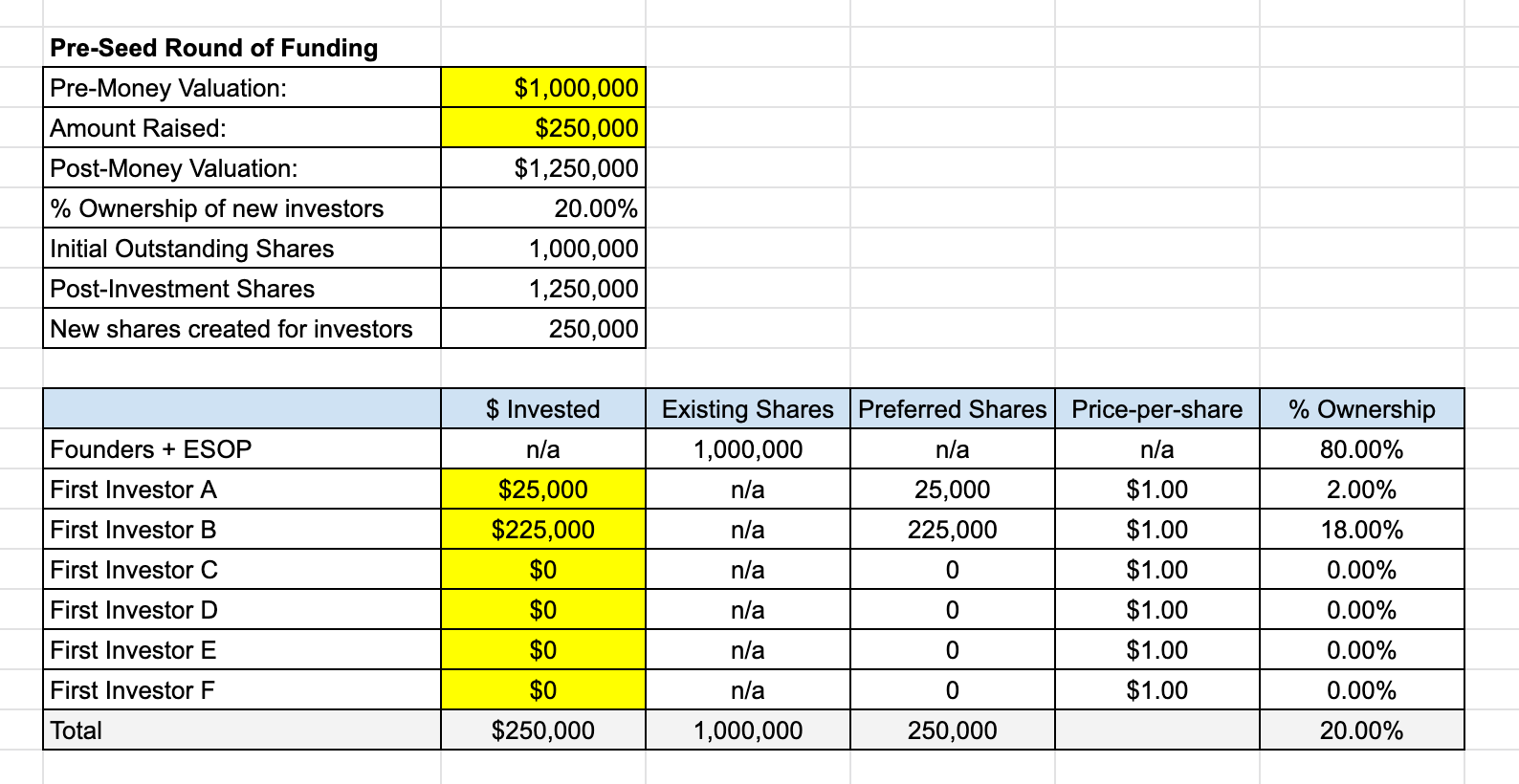

One thing about ideas, the idea person in the team, like who came up with the idea, I’d say, it doesn’t matter that much. I’m always thinking that, you know, if you look at idea versus the execution of the idea, the execution is like 100 times more important than any idea, because no idea will have any matter if the execution doesn’t work. So think more about like, what is the who’s gonna be doing the executing stuff? And think about the next 10 years of working with the team working on this opportunity, working with the risks involved? What do you deserve? And you can you can then figure out, like, what do you really want? Here’s a few kind of anecdotes for, for founders to think about. Like, you could be saying, in your mind that, in five years, this founder will be the most valuable founder of all of these co founders driving success for the company, or that this founder, will be least likely to still contribute to the success of the company in five years. So if you’re doing that, group exercise, as co founders, you could think about questions like, when things go bad, who will leave the first like, Who’s gonna, who’s gonna not have that risk? Taking ability, when you can’t pay a salary anymore? For instance, like you were, you raised some money, and then the money ran out, will you leave if like you, you need to go for four months, six months, eight months without a salary. And also that Christos, those, those rough patches on the journey of a company, I think it always happens to companies. Like there’s, there isn’t a next, like, an example of a company that never had tough times. So when those tough times happens, like who will go through and push forward in those bad times, like mentally and rally everybody, usually it is the CEO. So you have to have that discussion is the CEO, that kind of a person who will go through that situation. So check out the tool by going to the templates on Elliot game developers.com. It’s the co founder equity split tool. Then let’s talk about the funding rounds, and how that actually affects the the founders equity and ownership in the company. And, like, how will things changed as the investors are coming on board? So think let’s go back to this example of 25% for four co founders. What would happen if they raised let’s say 200,000 at a company pre money valuation of one emilian, meaning that before the money comes in the company’s worth 1 million, and then when the 200,000 comes in, there’s something called the post money valuation, which would be 1.2 million. That means that the investors will own a significant part of the company already. So the founders who owned 25%, will now own about 20.8%. Each. And the newest investors who put 200,000 into the company will own 16.6% at that stage. So there are new shares being created.

Joakim Achren 15:43

And those shares, the owners, the investors will own a total amount, which will go to 16.6%. So this is the first stage where you already start seeing that investors are starting to own part of the company. And then what you usually want to do at this stage, when you have your first money coming in, is that you want to incentivize your employees with shares as well. So thinking about like an option pool coming into place. And there’s, there’s an ownership, usually that you want to structure there, which would be that 10% of the company would be sort of like parked into this option pool. So what what the investors usually want to do is that this option pool is created from the founder shares, so that the investors who came on in this round are sort of like not being diluted, because of the option pool, they want those option pools to be in place before the money comes in. That’s very common for all investors who are looking into putting money into into startups. So then what happens is, if you create an option pool with 10%, then the founders would go to 18.3% ownership each. So now you could think about like, hey, just raising 200,000. from investors, and creating that option pool, what happens is that the company actually goes into a mode of the founders owning 6.6% less than they owned before the funding round. So this is a consideration that I think is really key here for a lot of gaming studios who are, who are at that stage that it’s just the founders, if they have structured the founder, team in a way that they could start prototyping, maybe part time, maybe take off, like from work to do this for a while just, you know, run prototypes, play games, figure out ideas that would be really interesting to start executing on. And don’t raise cash before you have evidence that things are working. Like then you could skip raising 200,000 and immediately go to 1 million. But 1 million usually, like raising 1 million without numbers, and having, you know all the details in place about like how this will how the game will start scaling with user acquisition is really hard. I, I pretty much don’t see it. If it’s not a, you know, this kind of like triple A team that I’ve been talking about on my newsletter. So if it is like, a pretty like average gaming team, like really high professional and they know what they’re doing. But do you really want to do that dilution of going from 25% ownership to 18.3 when you don’t yet have evidence, because you’re going to be needing to raise more and more later on. And suddenly you own like 10% of the company to really get a sense of what all of those funding rounds, like if you raise 200,000 now then you raise 1.5 million, like a year later. And then 5 million a year later, the best advice from me would be to get that cap table modelling tool from Elite game developers.com from the templates page and start playing around with it, because it will show you how good it actually is to skip like a funding round or take as as little amount of cash as possible.

Joakim Achren 19:39

I’ve talked about this on the the angel investor episode in December of 2020. Where I’m thinking about the model of like, which is very popular in Silicon Valley now for tech startups is that you raise in tranches that you don’t immediately give up 20% of the company but rattle Give up 7% of the company to angels and raise as little as possible to get going for like eight to nine months for prototyping. And then you can show evidence and you can skip taking that big lump sum of money for a 20% dilution too early. And, of course, I’m thinking about like investing as well. And I really love to see companies going into the, to the investment path. But I really hate seeing when the founders don’t own more than 5% of their company anymore. When they’re doing an exit later in their career. It’s, it’s just like, where all of those funding rounds really necessary. Like, if not, like, how do you kind of like work backwards from there to figure out how do you create evidence? How do you create traction and product market fit and retention numbers? And you start doing user acquisition that scales? What are the funding mechanisms that you can get to those points where you don’t really necessarily need investor money? If you if you want to kick off another game team, if you want to hire people, then for sure, think about fundraising. But as the at the early stages, can you just bootstrap the founding team, to a certain point where you have the numbers? I’ll highlight a few important things here that are also related to the fundraising moments. So I think like, if you go and raise early round of 200,000, or half a million or a million, try to make those funds matter a lot so that the runway actually lasts. What do you need to actually like build the product that you want to build? early on? I recently had her g shoe from a lucky cat talking about his early like, success in gaming. And their companies like I think it’s almost 20 people. And it’s a bootstrapped company where the founders own and the staff on 100% of the company. So they started doing like small games, and gradually going towards more harder games. And then they, they went into mid core, but they decided to scale down mid core and go back to hyper casual, because it was just you know, too capital intensive, too much unknown uncertainties. How do you get like shorter, like, pay like phases of uncertainty where you have points where you know what’s going on. So I think one of those ways that how how you actually can bootstrap is just start making smaller games as your first games don’t immediately go after and empires and puzzles kind of game. That’s what I would, I would definitely not want to do in my career in the future. As an investor, I also look at it as a bigger risk. Because like, of course, it’s a big opportunity to make game that will succeed, if everything goes right. But I also feel that if it doesn’t, it’s it’s a path that the founders might end up raising a lot of money again, and the success might still not be there. And suddenly the founders own 5% of the company. So the second point that I want to do is this dilution optimization. Play around with the tool that I have on the templates page in elite game developers.com. To think about, like, could you actually bootstrap for a while before you raise money, when you have some prototypes? Maybe you just take a few angels on board and figure things out in a much sort of like, de risking manner, de risking the dilution. I mean.

Joakim Achren 24:14

And then, one final thing regarding like, the cap table that I’ve, I’ve seen before companies that, you know, built up a big organisation, they were building a big game. There are these moments when the cap table looks really bad that the founders only own like 20% of the cap table anymore. There are certain ways to start restructuring the company called this kind of like process of recapitalisation where the investors sort of like, agree with the founders that Yeah, things didn’t go out well, but we don’t want you to leave but we’d rather start from scratch with ownership. like giving the founders another chance by just going back to zero in the investor ownership and starting again, with with a new front raise, building up on top of the the previous sort of knowledge that is in the company, meaning that the cap table goes back to founders owning 100%, including staff with their options, but the investors sort of like take the hit. And investors are yet again betting on the founders. So it’s more about like, Is there a relationship with the founder and the investors that the investors believe in the founders capabilities that they’re constantly learning, they took a risky bet, which didn’t work. But hey, I’m gonna bet on your next thing as well. Don’t start a new company, let’s just continue with this company, we’ll put more money in from and we start the dilution for the founders from from 100%. Again. So I’ve seen this happen, I’m going to try to write some examples of how this could work for startups that are in this kind of jam, because I know a lot of companies that are in that kind of chat where the founders only own a few 10% of the company and they, they still need to be pushing. So to end up this episode, I want to point out the URLs again. So the co founder equity split tool is under elite game developers.com slash co founder and the cap table modelling tool is under elite game developers.com slash cap table. And if you ever have questions regarding the cap table, you can always ping me on on LinkedIn. I’m happy to give my advice on tricky situations. All right, this was this kind of like different kind of episode. I hope you like this kind of like going through a process that I’ve gone through where I’ve noticed stuff. I’m going to be doing these more of these. So send me feedback. I’m happy to hear every kind of feedback that you can give me and we’re going to have an another interesting guests next week on the podcast. So stay tuned for that one. And do subscribe to our weekly newsletter at elite game developers.com. See you next week. Bye bye.

Transcribed by https://otter.ai