EGD News #101 — Fear-setting

Sent on September 24th, 2021.

If you aren’t a subscriber to EGD News, you can subscribe here.

😱 Fear-setting

“We suffer more often in imagination than in reality.” — Seneca.

The need to write this piece starts with a recent realization. I had Tomi Kaukinen, burnout expert, on my podcast during the summer. After the interview, we continued to chat about our startup experiences. We were talking about sleep quality before and after our startups. I told Tomi that just the other night, I had this dream of my company going bankrupt. And Tomi understood where I was coming from. I also told Tomi that I have the same dream quite often.

After the Zoom call with Tomi, I went back to Sophie Vo’s masterclass on anti-fragile teams, where she talked about Tim Ferriss’ Fear-setting exercise. I understood that Tim’s exercise could help me with what I was going through.

Fear-setting is an exercise where you visualize your fears in detail to approach a state where you finally overcome the paralysis of the fears.

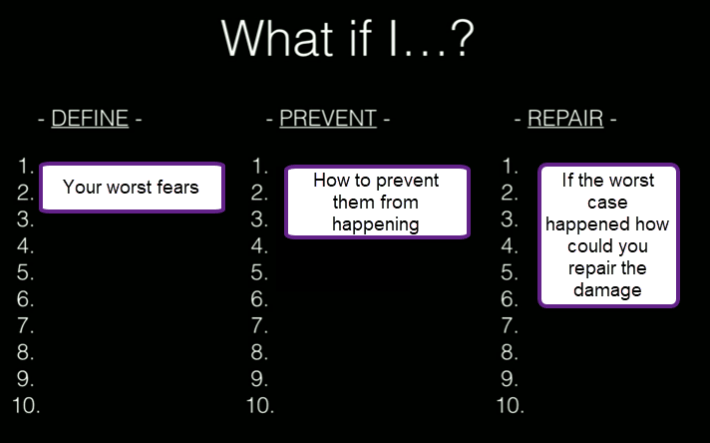

You first define each fear by writing them out in the form of “What if I…?”

Here are some examples: “What if I lost my company?” or “What if I lost all my money?” or “What if I fail with my game project?” or “What if I lost my lead game designer?”

After you’ve defined your fear, you move on to prevent that fear from becoming true.

To prevent the fear, ask yourself: What could I do to prevent or decrease the likelihood of this happening? Write down the answer.

Then finally, Repair: If the worst case happens, what could you do to undo the damage?

All you need to write down is Define, prevent and repair. Write out as many as fifteen or twenty fears.

How could I help myself understand what I was dreaming about and control my dreams and the emotions associated with the fear?

I’d need first to define the fear.

What if I lost my company? Next Games is doing good, but what if there was a catastrophic event where the company had to shut down. I would lose all the assets that I still own in the company, and I would be left without something to show for as a games company I founded. The financial hit would be severe, including some losses on the credibility side as well.

How to prevent the fear from becoming a reality?

I haven’t been working at the company anymore for two years, so I don’t have control over the company’s faith. Since the whole practice of fear setting is training yourself to what you can control and can’t control, I needed to find other ways to prevent a financial hit and a credibility hit.

To repair the worst-case scenario, let’s tackle the financial and credibility hits.

Financial hit: I would do alright even without the company stock. I’m doing many projects at the moment where I’m getting paid. And I’ve invested in a dozen and more gaming startups in the last two years. Half of them have already raised a bigger round after I invested. I can focus on the current and future, which is full of possibilities. The past is what it is, and if all would go to zero, I’d have the skills to build things up again.

Credibility: startups and companies fail all the time. Demonizing failure doesn’t help anybody. The only thing we can do is show that we learn from our mistakes and share those learnings with as many people as possible. As an investor, I look at resumes, like OK, you worked at King, Supercell, or Peak Games, that’s awesome. But what was your role there?

Most importantly, what did you pick up from working there? List out the stuff for me, and then I know your credibility. What mistakes did you make, and what did you learn from them?

As a bonus, Tim also shares a tool called “The Cost of Inaction” for looking at inaction to your fears or underlying habits that cause fear. Ask yourself: if I avoid this action/decision, what would my life look like in 6 months, 12 months, or three years.

To finish off this piece, I recalled a podcast episode from Tim Ferriss on fear-setting in 2020.

In April 2020, Tim Ferriss had a podcast with Ryan Holiday, and he talks about his fear-setting when the pandemic hit and his ownership in Uber tanked in 70% in value.

He got advice at 40 dollars per share that he’d need to hold when the share price hits $15 or $20. Two weeks later, it hit $14 a share. “I struggled a lot,” said Tim. Here’s a link to how the discussion went.

🚀 Alli Ottarsson — From operator to VC

This week I had Alli Ottarsson on the podcast. Alli is a Principal at gaming investments firm Makers Fund. Alli has had a long career in gaming, working at CCP on EVE Online, then at Riot Games on League of Legends. Recently he started doing angel investing and then eventually joined Makers Fund to become a VC. In the discussion, we talk about the game development lessons that Alli has learned and how he is now applying those lessons to investing.

Here are my highlights from the discussion.

Talking about Riot Games, what were the dissimilarities from how a successful Nordic games company would operate?

Generally I think of the Nordic Leadership style to be more collaborative with a much flatter structure. And I think the Nordics were ahead of the curve with cross functional teams in games with a high level of agency and even autonomy.

We hired a bunch of folks from the Nordics into leadership positions. We hired folks from Canada also into leadership positions, and the UK. Canada is kind of like in the in the middle there, between what I look at as Nordic culture.

We did regular knowledge sharing sessions with Nordic companies, for example, with Spotify, we visited their offices in Stockholm. We also visited all the gaming companies in Stockholm for those purposes, during that same trip, and we had folks from Spotify come to our offices in Santa Monica, to do knowledge sharing sessions.

What do you think are the characteristics of the teams who can take a game studio from zero to hugely profitable?

I think it’s obsessing with the industry and with the audience. Really deeply understanding the audience that you want to serve, and have the right motivations to serve that audience.

[Having] sharp and divergent perspectives. Founders that have diversity of thought on their team and diversity of backgrounds. Most importantly having a clear and concise vision. Really crystalized, but at the same time, having the adaptability and willingness to be flexible and having an iterative or testing approach. And then just tenacious and scrappy founders with lots of drive.

Listen to the full episode by going here.

🗓 In case you missed this on EGD

- Ask Me Anything #3

- How To Evaluate Mobile Game Ideas

- Interview with Klaas Kersting, Phoenix Games

- No hierarchy at a game studio

- Valuations for early-stage startups

- Designing a merge game

- Publishing mobile games in Africa

- 10 Favorite Books of 2021 so far

📃 Articles worth reading

+ Four Growth Paradigms: Zynga, Applovin, Skillz, and Jam City — “We’re nearing the end of the “easy pickings” phase for game company growth through M&A. Zynga has arguably been the most successful of mobile game companies at leveraging M&A for growth over the past 5 years. While Zynga has continued to show growth over the past year and likely has growth locked in for the next few years, the big question moving forward is how do they continue growing longer-term?”

+ Can Supercell Boost Beatstar Into a Major Hit — “The challenge of scaling Beatstar is in the poor monetization of the music games. With organic traffic being what it is, Beatstar, just like all of the game on the market, has to rely on performance marketing to continue its growth. In other words, increasing LTV and decreasing CPI is crucial for Beatstar to continue to scale.”

+ The 10 Rules For Mobile Game LiveOps — “The point of liveops is to create a sustainably relevant, exciting, and adored game. Having the right foundation and the right core strategy pieces is important, but being able to connect those tenets through esteemed tips & tricks is revolutionary.”

💬 Quote that I’ve been thinking about

“It’s more fun to be a pirate than to join the navy.” — Steve Jobs

Sponsored by Pollen VC

Pollen VC provides flexible lines of credit to mobile app and game developers, enabling you to borrow up to 4x your monthly revenues on a simple, transparent interest rate basis.

Unlock the value trapped in your platform receivables (AR) and in your existing marketing cohorts – get an elastic line of credit that flexes in line with your business growth. Capital can be rapidly reinvested back into user acquisition to help growth without relying on dilutive venture capital funding, or expensive revenue based loans.

Go to www.pollen.vc to learn more.

Sponsored by Opera Event

Looking for some great new authentic video creative? Try something totally new with Influencer Generated Content (IGC) by Opera Event. Influencers or actors will make specific creative content for your games and Opera Event will deliver you high-quality video ads that highlight the best parts of your game.

Note! You get a free video with the purchase of 4 or more videos. Remember to say that Elite Game Developers sent you!

Go to www.getigc.com to see some examples and get more information.

If you’re enjoying EGD News, I’d love it if you shared it with a friend or two. You can send them here to sign up. I try to make it one of the best emails you get each week, and I hope you’re enjoying it.

I hope you have a great weekend!

Joakim